When selling a rental property, landlords face a crucial decision: sell with sitting tenants or vacate the property first. This choice can significantly impact the sale price, timeline, and overall process. While conventional wisdom often suggests vacant properties sell for higher prices, the reality is more nuanced. Each approach offers distinct benefits and disadvantages that must be carefully weighed based on your specific circumstances, property type, and market conditions. This complete guide explores the pros and cons of both options to help landlords make informed decisions.

Selling with Tenants: The Pros

Continued Rental Income

Perhaps the most obvious advantage of selling with tenants in place:

- Cash flow maintenance: Income continues throughout the marketing and sales process

- Holding cost coverage: Mortgage, insurance, and maintenance expenses remain offset

- Reduced financial pressure: Less urgency to accept lower offers due to financial strain

- Cumulative impact: For longer sales processes, the total income can be substantial

- Tax year considerations: Potential to maintain income in specific tax periods

Maintaining rental income during a lengthy sales process provides crucial financial stability for many landlords, particularly those with mortgages or other financial commitments.

Demonstrated Investment Performance

Tenanted properties offer tangible evidence of investment performance:

- Proven rental value: Actual rather than theoretical income

- Occupancy demonstration: Evidence of property’s rentability

- Tenant quality verification: Established payment history and behaviour

- Management reality: Clear picture of actual management requirements

- Expense History: Documented maintenance and running costs

This “real-world” performance data can particularly appeal to investment buyers who value proven track records over theoretical projections.

Investor Appeal

Tenanted properties specifically target the investor market:

- Ready-made investment: Immediate income without setup delays

- Tenant acquisition savings: No marketing or vetting costs

- Void period elimination: No income gap during tenant finding

- Established relationships: Existing tenant-landlord dynamics

- Operational continuity: Seamless transition of ongoing tenancy

These advantages can make tenanted properties particularly attractive to buyers seeking investment properties, potentially commanding premium prices from the right purchasers.

Property Presentation Benefits

Occupied properties offer certain presentation advantages:

- Lived-in appeal: Furnished and occupied spaces often appear more inviting than empty rooms

- Scale demonstration: Furniture helps showcase room sizes and functionality

- Maintenance evidence: Occupied properties demonstrate habitability

- Security benefits: Reduced vacancy-related security concerns

- Utility functioning: Active services demonstrate working systems

While tenant occupancy can sometimes present challenges for presentation, a well-maintained tenanted property can show better than an empty one, particularly in demonstrating livability and functionality.

Simplified Process for Landlords

Selling with tenants can streamline the process for landlords:

- Reduced preparation: No need to coordinate tenant vacation

- Maintenance continuation: Ongoing tenant responsibility for basic upkeep

- Utility management: Continued tenant responsibility for services

- Security preservation: Occupied properties face fewer security concerns

- Legal simplicity: No eviction or possession proceedings are required

This operational simplicity can make the selling process significantly less stressful and time-consuming for landlords, particularly those with limited time or managing properties remotely.

Selling with Tenants: The Cons

Reduced Buyer Pool

Perhaps the most significant disadvantage:

- Owner-occupier exclusion: Eliminates buyers wanting to live on the property

- Financing limitations: Some mortgage products aren’t available for tenanted properties

- Investor-only market: Restricts competition to a smaller buyer segment

- First-time buyer elimination: Excludes a significant market segment

- Renovation-focused buyer exclusion: Deters those wanting immediate property access

This restriction typically translates to fewer offers and potentially lower sale prices, particularly in markets dominated by owner-occupiers.

Viewing Challenges

Coordinating viewings with tenanted properties presents practical difficulties:

- Access restrictions: Tenants’ right to reasonable notice and convenience

- Presentation concerns: Limited control over cleanliness and presentation

- Scheduling complications: Working around tenant availability

- Privacy issues: Tenant possessions and personal items on display

- Potential resistance: Uncooperative tenants may complicate or sabotage viewings

These challenges can extend the marketing period and potentially deter some buyers who become frustrated with limited access opportunities.

Valuation Impact

Tenanted properties typically command lower prices:

- Tenancy discount: Generally 10-30% below vacant possession value

- Condition uncertainty: Limited ability to address presentation issues

- Renovation restrictions: Inability to showcase improvement potential

- Buyer perception: Assumption of problems with tenanted sales

- Market expectations: Traditional expectation of discounts for tenanted properties

This price differential must be carefully weighed against the benefits of continued income and simplified process.

Legal Complexities

Selling with tenants involves additional legal considerations:

- Tenancy transfer: Legal requirements for transferring tenancy obligations

- Deposit handling: Proper transfer of protected deposits

- Disclosure requirements: Obligation to provide complete tenancy information

- Contractual limitations: Potential restrictions in existing tenancy agreements

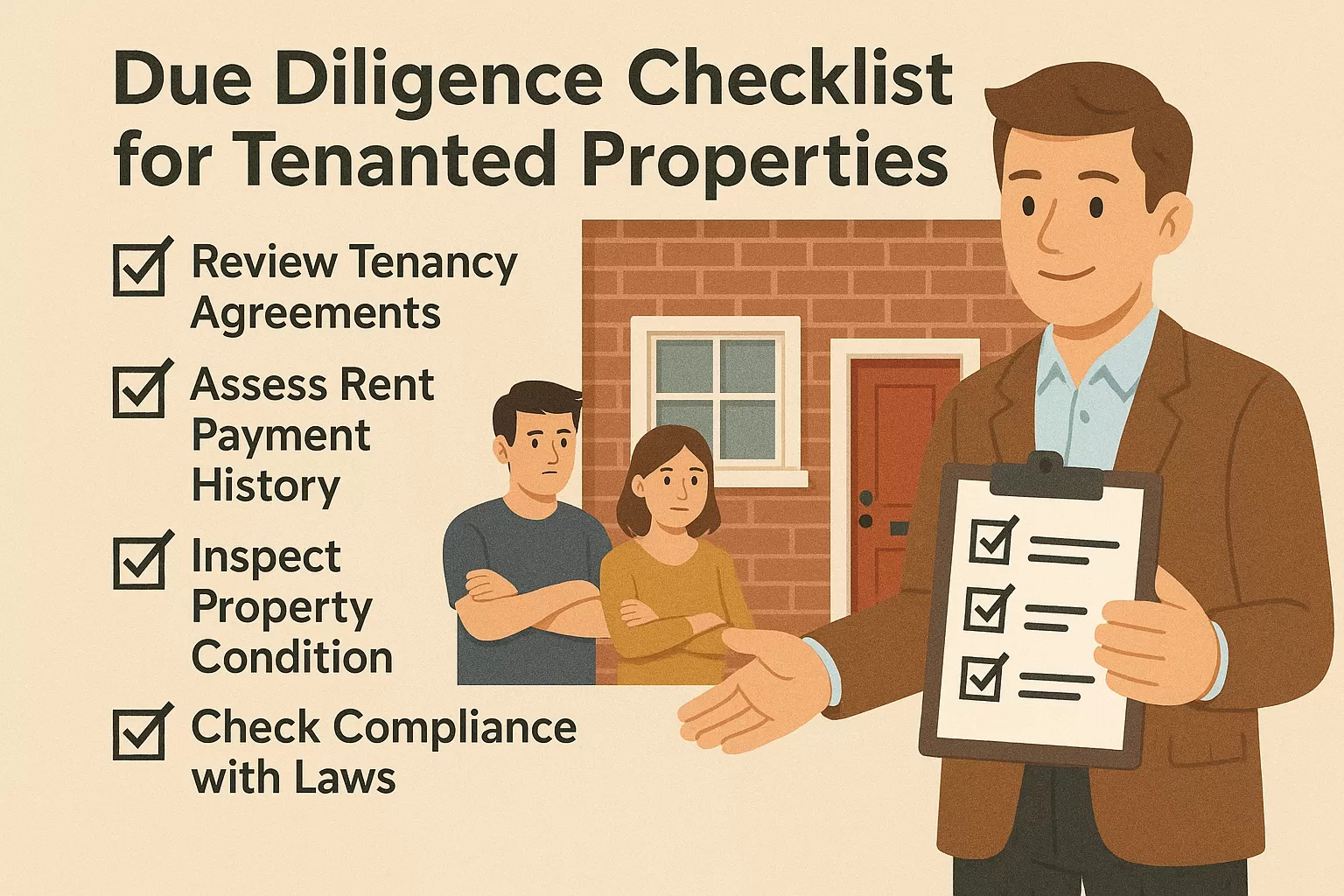

- Buyer concerns: Additional due diligence requirements for tenanted properties

These complexities can extend the legal process and sometimes deter less experienced buyers.

Tenant Behavior Uncertainties

Tenant cooperation cannot be guaranteed:

- Viewing resistance: Potential difficulty arranging property access

- Presentation sabotage: Risk of deliberate poor presentation

- Information sharing: Tenants may share negative information with viewers

- Negotiation leverage: Buyers may use tenant issues to negotiate price reductions

- Completion complications: Potential for problems during ownership transition

While many tenants are cooperative, tenant behaviour’s unpredictability represents a significant risk factor in tenanted property sales.

Selling Vacant Property: The Pros

Maximum Market Appeal

Vacant properties attract the broadest possible buyer pool:

- Owner-occupier inclusion: Appeals to those wanting to live on the property

- Investor inclusion: Remains attractive to investment buyers

- Developer appeal: Accessible for those planning significant changes

- Financing flexibility: Compatible with all mortgage types

- Immediate availability: Appeals to buyers with urgent timeframes

This broader appeal typically means more viewings, offers, and potentially higher sale prices.

Presentation Control

Vacant properties offer complete presentation flexibility:

- Professional staging: Opportunity for optimal furniture arrangement

- Cleanliness assurance: Perfect presentation for every viewing

- Redecoration options: Ability to update décor to current trends

- Issue remediation: Opportunity to address any maintenance concerns

- Space maximization: Removal of excess furniture to showcase space

This control allows for optimal presentation tailored to target buyer preferences, potentially commanding premium pricing.

Viewing Flexibility

Vacant properties eliminate access restrictions:

- Scheduling freedom: Viewings at optimal times for market (evenings/weekends)

- Last-minute arrangements: Ability to accommodate spontaneous interest

- Open house potential: Opportunity for multiple simultaneous viewings

- Lockbox options: Self-showing potential for agent efficiency

- Extended viewing duration: No time pressure from occupant needs

This flexibility can significantly accelerate the marketing process and improve buyer experience.

Higher Sale Price Potential

Vacant properties typically command higher prices:

- Premium buyers: Access to owner-occupiers often willing to pay more

- Emotional purchasing: Buyers can envision themselves in the space

- Negotiation position: Fewer complications to leverage for price reductions

- Competitive bidding: A broader buyer pool can drive competitive offers

- Financing advantages: More mortgage options can improve buyer budgets

This price premium often ranges from 10-30% compared to equivalent tenanted properties.

Simplified Legal Process

Vacant property sales involve fewer legal complications:

- Standard conveyancing: Familiar process for all parties

- Reduced disclosure: No tenancy details to document

- Deposit simplicity: No tenant deposit transfers to manage

- Contractual clarity: No tenancy terms to assign

- Completion simplicity: No tenant management during ownership transfer

This streamlined legal process can reduce transaction timeframes and minimize the risk of complications.

Selling Vacant Property: The Cons

Loss of Rental Income

The most immediate financial impact:

- Immediate cash flow reduction: Income stops when the tenant vacates

- Holding cost exposure: Full responsibility for mortgage and expenses

- Cumulative impact: Potentially significant for longer sales processes

- Financial pressure: May create urgency to accept lower offers

- Tax implications: Potential effects on income tax position

This income loss must be carefully calculated against the potential for higher sale prices.

Property Vacancy Risks

Empty properties face specific risks:

- Security concerns: Increased vulnerability to break-ins or vandalism

- Insurance implications: Potentially higher premiums or coverage restrictions

- Maintenance visibility: Issues more apparent without occupant reporting

- Utility management: Need to maintain minimal services

- Seasonal challenges: Heating requirements in winter, garden maintenance in summer

These risks require active management and potentially additional costs during the sales period.

Upfront Costs

Preparing a vacant property involves immediate expenses:

- Cleaning costs: Professional cleaning after tenant departure

- Redecoration expenses: Painting and cosmetic improvements

- Maintenance catch-up: Addressing any deferred maintenance

- Staging considerations: Potential furniture rental for presentation

- Garden and exterior upkeep: Ongoing maintenance requirements

These costs must be factored into the financial equation when comparing approaches.

Potential Legal Complications

Creating vacancies may involve legal processes:

- Notice requirements: Proper legal notice to end tenancies

- Eviction potential: Possible court proceedings if tenants don’t vacate

- Deposit disputes: Potential disagreements over deposit returns

- Tenant claims: Risk of retaliatory actions from displaced tenants

- Compliance requirements: Make sure all legal obligations are fulfilled

These legal aspects can add time, cost, and stress to creating vacancies.

Market Perception Concerns

Vacant properties can raise specific buyer concerns:

- Vacancy Duration: Questions about why the property hasn’t sold

- Maintenance questions: Concerns about hidden issues without occupants

- Neighbourhood concerns: Empty properties may suggest area problems

- Pressure perception: Assumption that seller is motivated by vacancy costs

- Rental viability questions: Investors may question why the property isn’t tenanted

These perception issues require careful marketing to address and overcome.

Decision Framework: Making the Right Choice

Financial Calculation Approach

A mathematical approach to decision-making:

- Calculate vacancy cost: Monthly rental income × estimated sales period

- Estimate price differential: Likely vacant sale price vs. tenanted sale price

- Factor preparation costs: Expenses required for vacant presentation

- Consider time value: Impact of a potentially faster vacant property sale

- Evaluate tax implications: Different approaches may have tax consequences

This quantitative analysis provides an objective foundation for decision-making.

Property-Specific Considerations

Different properties may favour different approaches:

- High-demand residential areas: Vacant often better for owner-occupier appeal

- Strong rental investment areas: Tenanted may attract premium investor interest

- Luxury properties Usually benefit from vacant, staged presentation

- Standard rental units: Often sell well with tenants demonstrating rental viability

- Properties needing renovation: Almost always better vacant

The optimal approach varies significantly based on property characteristics and location.

Tenant Relationship Factors

Existing tenant relationships influence the decision:

- Long-term quality tenants: May enhance value for tenanted sale

- Problematic tenants: Strongly favour a vacant approach

- Cooperative tenants: Can make the tenanted sales process smoother

- Tenants with special protections May make vacant sales impractical

- Tenants open to incentives: May facilitate either approach

The nature and quality of tenant relationships significantly impact the feasibility of each option.

Market Timing Considerations

Market conditions affect the optimal approach:

- Hot seller’s markets: Vacant typically maximizes competitive bidding

- Slow markets: Tenanted maintains income during more extended sales periods

- Strong rental markets: Tenanted properties more attractive to investors

- Seasonal factors: Vacant more advantageous during peak buying seasons

- Interest rate environments: Higher rates may increase investor focus on immediate yield

Timing the approach to market conditions can significantly impact outcomes.

The Hybrid Approach: Conditional Strategies

Tenant Cooperation Agreements

Structured arrangements with existing tenants:

- Marketing period cooperation: Agreements for viewing access during marketing

- Conditional vacation: Arrangements for tenants to vacate upon sale agreement

- Incentivized presentation: Compensation for maintaining show-ready condition

- Flexible notice arrangements: Negotiated terms beyond statutory requirements

- Post-sale options: Potential for tenants to remain with new owners or receive priority for other properties

These negotiated approaches can combine the advantages of both methods.

Staged Vacancy Creation

Strategic vacancy timing:

- Initial marketing with tenants: Begin process while maintaining income

- Targeted vacancy creation: Create vacancy once serious interest emerges

- Partial property vacancy: In multi-unit properties, strategically vacate specific units

- Renovation-linked vacancy: Coordinate tenant departure with improvement plans

- Seasonal timing: Align vacancy with optimal market periods

This phased approach can minimize income loss while maximizing presentation advantages.

The Direct Buyer Alternative

For landlords seeking to avoid the complexities of both approaches, specialized property buyers offer a compelling third option:

- Purchase in any condition: Ability to buy regardless of tenancy status

- Flexible approaches: Can work with either tenanted or vacant properties

- Simplified process: Streamlined procedures without traditional marketing

- Certainty focus: Emphasis on completion rather than maximum price

- Speed advantage: Typically faster than either traditional approach

These buyers can purchase properties with or without tenants, often completing transactions in weeks rather than months, regardless of property condition or tenancy situation.

Conclusion

The decision to sell tenanted or vacant property involves balancing multiple factors, including financial considerations, property characteristics, tenant relationships, and market conditions. While vacant properties typically command higher prices and attract more buyers, tenanted properties offer continued income and operational simplicity during sales.

Specialized property buyers offer an attractive alternative to traditional sales methods for many landlords, particularly those with problematic tenants or complex property situations. These tenanted property specialists purchase properties regardless of tenancy status, eliminating many of the complexities and uncertainties associated with conventional marketing approaches.

Whether choosing to sell tenanted, vacant, or through a direct buyer, a thorough analysis of your circumstances remains essential. By carefully considering the pros and cons of each approach against your particular situation, you can determine the optimal strategy for achieving your property sale objectives.